Research Conducted by University of Birjand Faculty Member: Transformation in Business Financing – The Role of Private Markets in the Post-Crisis UK Economy

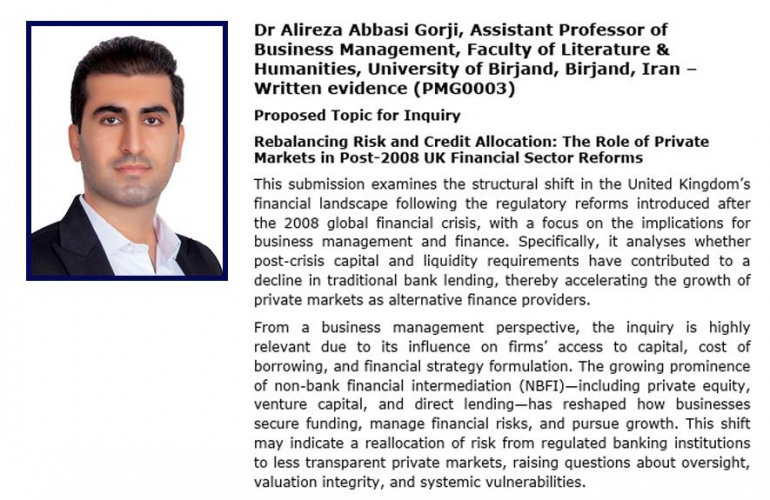

Dr. Alireza Abbasi Gorji, Assistant Professor of Business Administration at the University of Birjand, has submitted a research report entitled “Risk Rebalancing and Credit Allocation: The Role of Private Markets in UK Financial Sector Reforms after 2008” in response to the call for evidence by the Financial Services Regulation Committee of the UK House of Lords. In this study, he examines the structural transformations of the UK financial system following regulatory reforms and analyzes their implications for financial management and corporate strategy.

According to the Public Relations and Information Center of the University of Birjand, the research highlights how new capital and liquidity requirements introduced after the global financial crisis significantly reduced traditional bank lending. As a result, private markets—such as venture capital, private equity, and direct lending—have witnessed remarkable growth. This shift has reshaped corporate financing practices and transferred risks from highly regulated banks to less transparent institutions.

The report also addresses key regulatory challenges in monitoring private market activities, the complex interconnections between banks and private entities, and the systemic risks arising from these interactions.

With a focus on the decline of bank lending and the rise of non-bank financial institutions, the study investigates the consequences of this transformation for corporate access to capital, financial strategies, and economic sustainability.

Drawing on data from the Bank of England, international research, and comparative analyses with the United States and the European Union, Dr. Abbasi evaluates regulatory challenges, systemic risks, and the competitive advantages of private markets. He further offers policy recommendations for improving financial regulations and strengthening financial stability.

This research provides valuable guidance for policymakers, financial managers, and institutional investors as they navigate the evolving landscape of business financing in the United Kingdom.

Link to article:

Your Comment :